Roth ira withdrawal calculator

It is important to note that this is the maximum total contributed to all of your IRA accounts. Account balance as of December 31 2021.

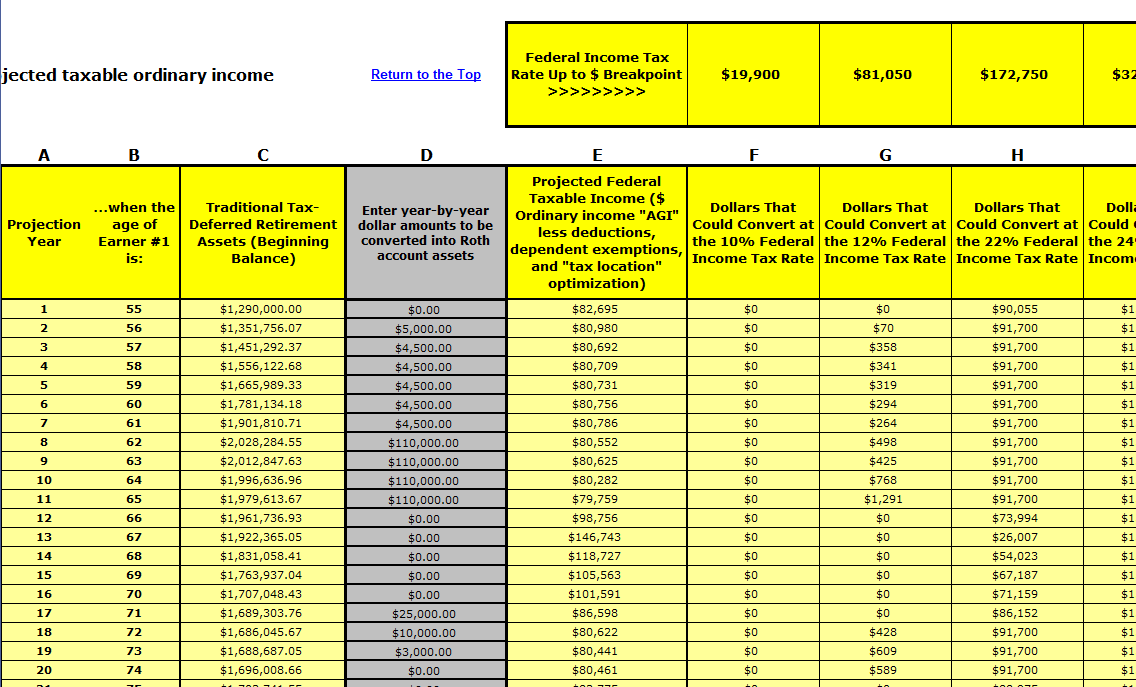

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Also you may owe income tax in addition to the penalty.

. Find a Dedicated Financial Advisor Now. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

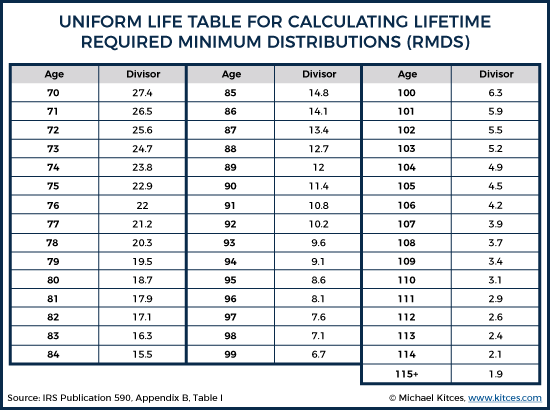

The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. Your life expectancy factor is taken from the IRS. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

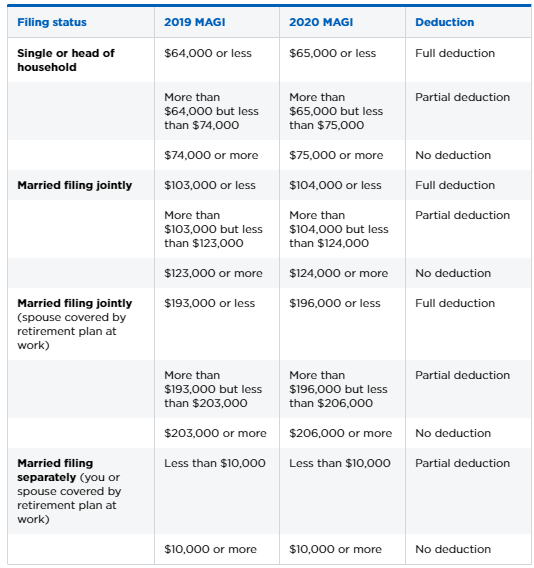

You can withdraw. You cannot deduct contributions to a Roth IRA. Do Your Investments Align with Your Goals.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Invest With Schwab Today. Annual Interest Rate This is the annual rate of return you expect to earn on your.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. That is it will show which amounts will be subject to ordinary income tax andor 10 penalty Please note that it assumes that you are the original owner of the Roth IRA ie you did not inherit it from somebody else. Get The Freedom To Plan For Your Income Needs And Legacy Goals.

Starting the year you turn age 70-12. The maximum annual IRA contribution of 5500 is. Traditional IRA Calculator can help you decide.

This calculator assumes that you make your contribution at the beginning of each year. Traditional or Rollover Your 401k Today. You can make contributions to your Roth IRA after you reach age 70 ½.

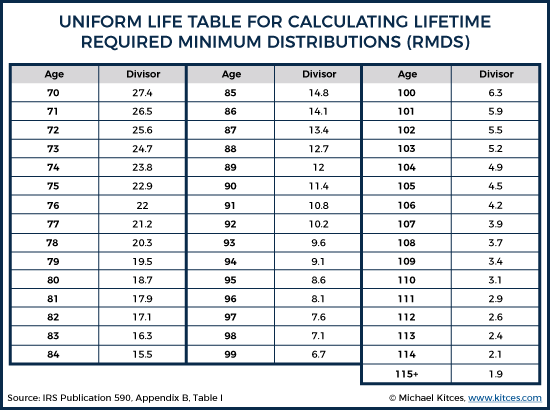

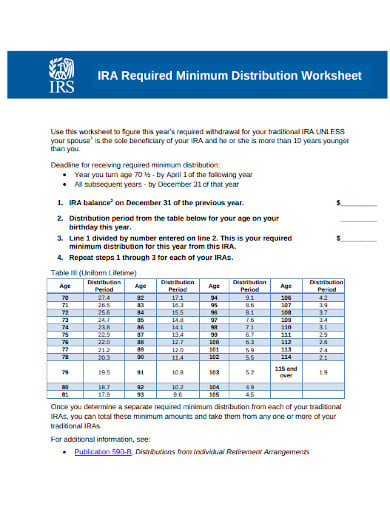

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each year.

The tools results represent analysis and estimates based on the information you have. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Build Your Future With a Firm that has 85 Years of Retirement Experience.

However Roth IRA withdrawals are not mandatory during the owners lifetime. This is how old you are today. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

2022 Early Retirement Account Withdrawal Tax Penalty Calculator. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. If you satisfy the requirements qualified distributions are tax-free.

Call 866-855-5635 or open a Schwab IRA today. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Ad Open an IRA Explore Roth vs.

Traditional IRA depends on your income level and financial goals. For some investors this could prove to. Roth IRA Distribution Tool.

Calculate the required minimum distribution from an inherited IRA. After turning age 59 ½ withdrawals from Roth IRAs are penalty-free. You can leave amounts in your Roth IRA as long.

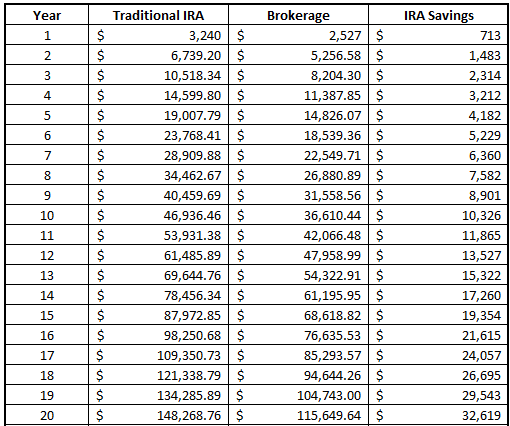

Revised life expectancy tables for 2022 PDF Important calculator assumptions. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you used. Amount You Expected to Withdraw This is the budgeted amount you will need to support your personal needs during retirement.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset growth tax consequences and penalties based on information you specify. Choosing between a Roth vs. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Use our IRA calculators to get the IRA numbers you need. For more detailed information and to do calculations involving Roth IRAs please visit the Roth IRA Calculator.

If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. Expected Retirement Age This is the age at which you plan to retire. Without distribution Roth IRAs can grow tax-free throughout the owners entire lifetime.

Retirement Withdrawal Calculator Terms and Definitions. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. The amount you will contribute to your Roth IRA each year.

Not everyone is eligible to contribute this muchor to contribute at all. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account. How is my RMD calculated. This tool is intended to show the tax treatment of distributions from a Roth IRA.

Read more about income limits for Roth IRAs below.

Roth Ira Conversion Calculator Excel

Ira Withdrawal Calculator Online 54 Off Www Alforja Cat

Best Roth Ira Calculators

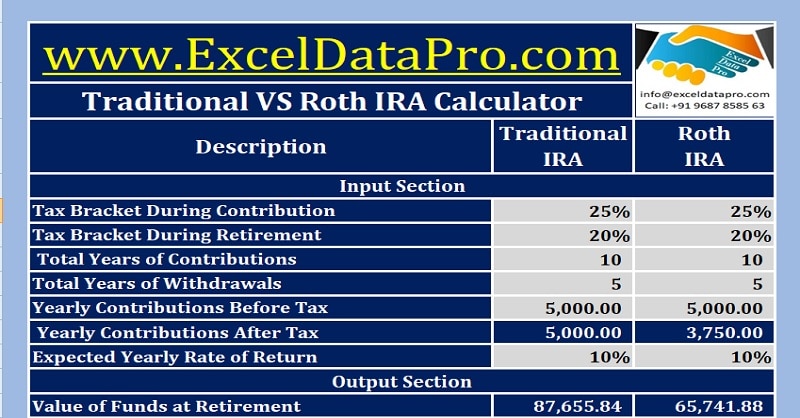

Traditional Vs Roth Ira Calculator

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

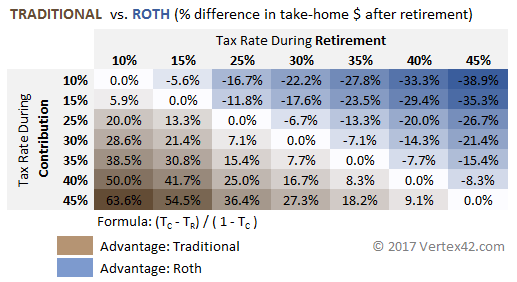

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Roth Ira Contribution

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Retirement Withdrawal Calculator For Excel

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Traditional Vs Roth Ira Calculator

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com